Unlocking Roth IRA Benefits for High-Income Earners: The Backdoor Roth Strategy Explained

If you're a high-income earner, you've likely run into income limits that block direct contributions to a Roth IRA. But there's good news: with a legal and IRS-acknowledged strategy called a "Backdoor Roth IRA", you can still enjoy the benefits of tax-free growth and withdrawals. Here's how it works—and why it may be worth considering.

1. Why Roth IRAs Are Valuable

- Tax-Free Growth: Contributions grow tax-free, and qualified withdrawals in retirement are also tax-free.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs don’t require withdrawals at age 73.

- Estate Planning Advantages: Assets can be passed to heirs tax-free, under current law.

2. The Income Limit Problem

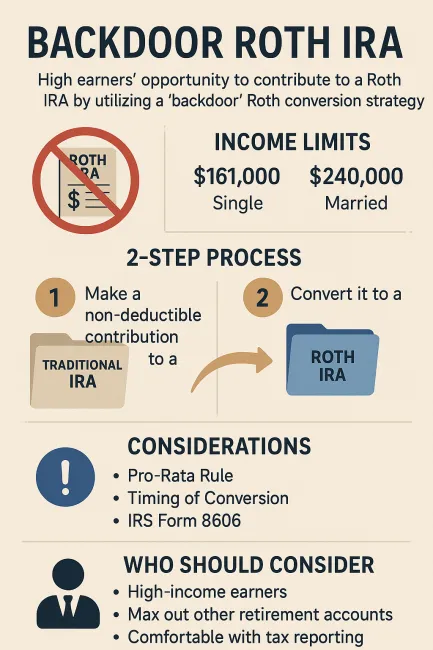

For 2025, the IRS prohibits direct Roth IRA contributions if your modified adjusted gross income (MAGI) exceeds:

- $161,000 (single)

- $240,000 (married filing jointly)

This shuts many professionals and business owners out of direct Roth savings.

3. Enter the Backdoor Roth IRA

This strategy lets you bypass income limits using a two-step process:

Step 1:

Make a non-deductible contribution to a Traditional IRA (up to $7,000 in 2025, or $8,000 if you're over 50).

Step 2:

Shortly after (often within days), convert that contribution to a Roth IRA. Because the original contribution was non-deductible and you've made no investment gains, the conversion is typically tax-free.

4. Important Considerations

- Pro-Rata Rule: If you have other pre-tax IRA balances (Traditional, SEP, SIMPLE), the IRS will calculate the tax owed on the conversion proportionally, which can reduce the tax efficiency of this strategy.

- Timing: It's smart to convert soon after contributing to avoid investment gains that could trigger taxes.

- Form 8606: This IRS form reports non-deductible contributions and tracks basis in your Traditional IRA to avoid double taxation.

5. Who Should Consider It?

- High-income earners who don’t qualify for direct Roth contributions

- Savers who already max out 401(k)s and HSAs and want more tax-advantaged growth

- Investors comfortable managing IRS reporting or working with a financial advisor

6. Final Thoughts

The Backdoor Roth IRA is a smart, perfectly legal strategy that allows high-income earners to sidestep income limits and enjoy the long-term benefits of Roth accounts. Like any financial move, it’s wise to consult a tax professional before proceeding—especially if you have existing IRA assets.

Call to Action

Curious if the Backdoor Roth IRA is right for you? At TaxSavingStrategies.com, we specialize in helping high-income earners evaluate their retirement options and implement tax-smart strategies. Visit our site to learn more or schedule a consultation—we’re here to help you make the most of your money.